INVESTMENT FOCUS

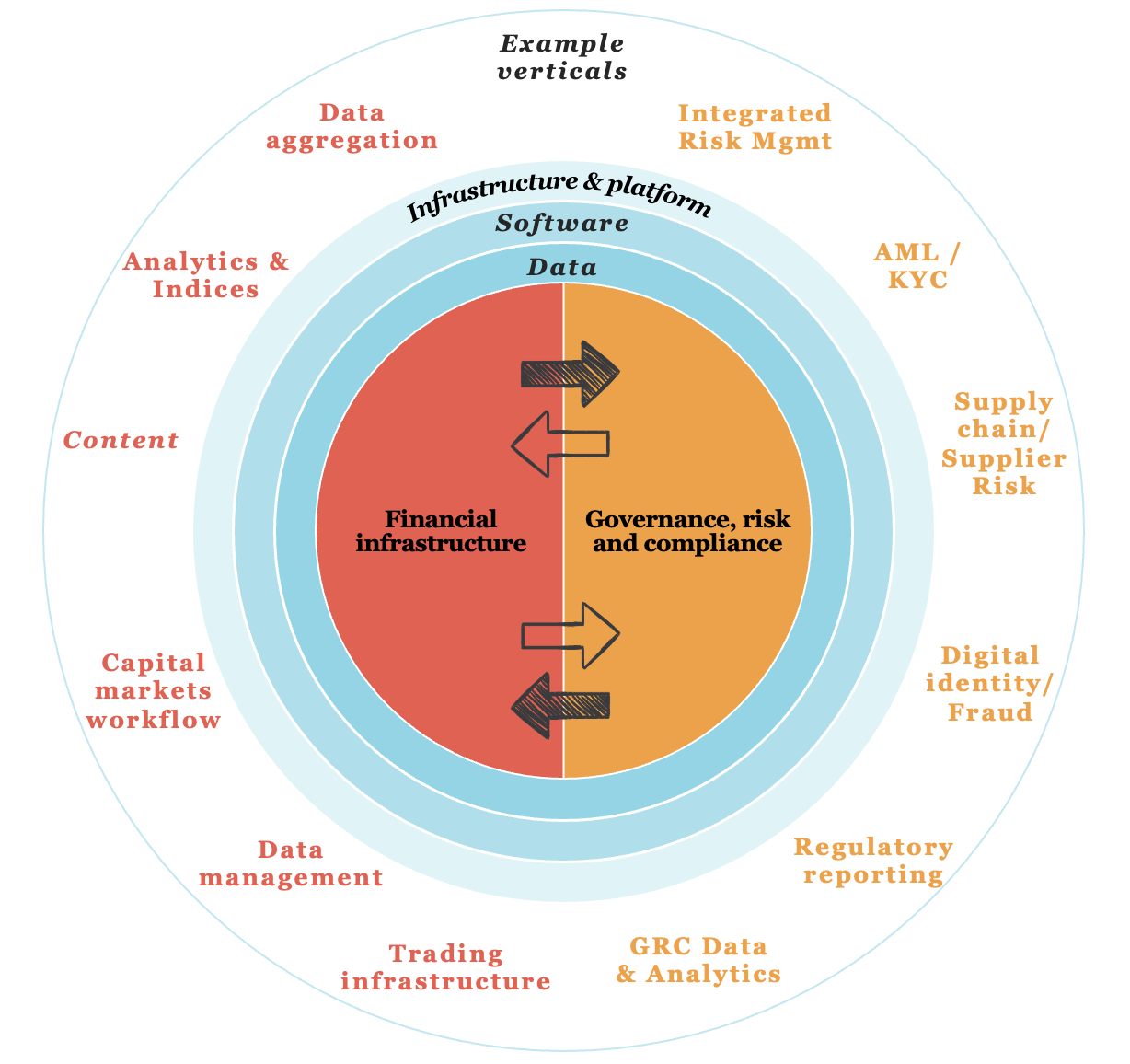

WE MAKE CONTROL INVESTMENTS IN SOFTWARE AND DATA B2B BUSINESSES WITHIN FINANCIAL INFRASTRUCTURE AND GOVERNANCE, RISK & COMPLIANCE

We source our opportunities off market and maintain a disciplined focus on our core verticals, making control investments in businesses with the following characteristics:

Software and data B2B businesses providing mission critical financial infrastructure and governance, risk and compliance

1.

Businesses headquartered in the UK or Northern Europe

2.

Established market position (niche market leader or strong challenger) in attractive segments with clear macro tailwinds

3.

Proven technology and IP with high-quality management teams who want to take the business to the next level

4.

Commercial traction – high levels of recurring revenues, net retention and profitable growth